capital gains tax proposal details

Short-term gains face a top rate of 434 percent including the 396 percent statutory rate plus the 38 percent investment income surtax and long-term gains defined as those with. Top 10 Tax Details in Biden Plan Advisors Should Know.

Gauge Your Tax Bracket To Drive Tax Planning At Year End Putnam Wealth Management

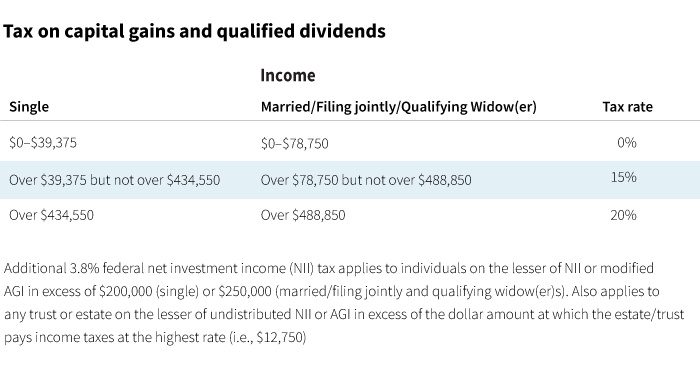

Under current law such capital gains have a two-tiered structure.

. President Bidens administration has made a proposal to increase the corporate tax rate. Understanding Capital Gains and the Biden Tax Plan. 53 rows Under Bidens proposal for capital gains the US.

The proposed plan would also mean higher taxes on foreign income. Long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million would be taxed at ordinary income tax rates with 37 generally being the highest rate 408 including the net investment income tax but only to the extent that the taxpayers income exceeds 1 million 500000 for married filing separately indexed for. The estate tax would revert to pre-Trump levels.

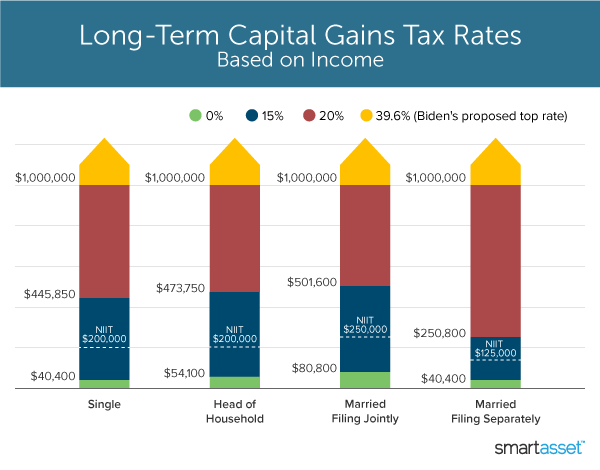

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. How Bidens Capital Gains Tax Plan Affects You. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. The proposal would allow 100 of the net capital gains to be deducted. The House Ways Means Committee has released draft legislation of individual tax hikes they propose to pay for the 35 trillion social policy budget plan under consideration.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains. Reform Corporate Income Tax Corporate tax levels directly affect economic activity in states and those with more competitive structures and rates are in much better positions to grow existing businesses and attract new ones.

The top capital gains tax rate would be 25. It would apply to single taxpayers with over 400000 of income and married couples with over 450000. Why the Biden Capital Gains Tax Increase Is Controversial.

Assets other than stocks may have different rates for capital gains taxes. Economy would be smaller American incomes. For taxable years beginning after January 1 2021 and before January 1 2022 the tax rate.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Real estate or business interests would not be taxed annually Wyden said but billionaires would still pay a capital gains tax including an interest charge of 122 percent up from 022 percent. The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise capital-gains taxesbut without the changes to.

The new proposal would be phased in for those with net worth between 100. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal rate of 396 percent and the 38 percent Net Investment Income Tax NIIT.

Bidens campaign proposal regarding capital gainsthe details. Under the proposal the new top rate on capital gains could be as high as 318 when combined with the surtax and an existing 38 investment income tax. Rather than the 21 enjoyed by many businesses from the Tax Cuts Jobs Act of 2017 C corporations would see a new 28 flat tax rate.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates. An increased top long-term capital gains tax bracket and a reduced estategift tax exemption.

It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed. This legislation calls for increasing the top individual tax rate from 37 to 396 and raising the capital gains tax rate from 20 to 396 for taxpayers with incomes higher than 1 millionand even higher for those required to pay the net investment income tax. The top capital gains tax rate would be 25.

Corporate Tax Rate Increase. Changes to International Tax. The release of the Biden administrations General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals commonly known as the Green Book makes clear that capital gains are among the administrations top tax targets.

Currently the top ordinary rate for individuals is 37 but. The Billionaires Minimum Income Tax included in the budget plan released by President Biden on March 28 would limit an unfair tax break for capital gains income and complement proposals the president has offered previously to limit other tax breaks for capital gains. Roth IRA conversions including backdoor Roth IRAs would be.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. If this happens it means they would be taxed at ordinary income tax rates as high as 396. The book which summarizes the tax proposals in Bidens proposed budget includes two broad proposals that.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

What Hsn Sac Details To Be Declared In Gst Returns Invoices Accounting Services Filing Taxes Tax Services

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Tax Hacks 2017 Don T Miss These 16 Often Overlooked Tax Breaks Capital Gains Tax Financial Apps Tax Deductions

Pin By The Taxtalk On Gst Deduction Income Taxact

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Income Slabs 2020 Budget 2020 Highlights Income Tax Return Budgeting Credit Card Design

Do You Know The Answer Click To Know Http Ow Ly Psh930p93th Mmkuiz Mymoneykarma Creditcard Tax Deducted At Source Unsecured Credit Cards Tax Refund

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Like Kind Exchanges To Be Limited Under Biden S Tax Proposals Mortgage Rates House Prices Mortgage

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Gst Tradehunger Stock Market Social Media Fee Waiver

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)